New Hampshire’s land market entering 2026 is characterized by rising land values and strong demand across various property types, from rural farmland to development-ready lots.

If you’re looking to sell your land for cash in New Hampshire, this guide provides a comprehensive overview of current trends, regional price differences, and actionable market value insights for landowners looking to sell land in the Granite State.

We focus on all types of sellable land (farms, timberland, residential lots, etc.) across the entire state – including notable county-level variations – using the latest data from credible sources like the USDA and market reports.

Key Takeaways

- Land Values Rising: New Hampshire land values continue to climb, with farmland averaging around $6,500 per acre in 2025, reflecting steady demand and development potential.

- Regional Price Gaps: Prices vary drastically: southern counties can reach tens of thousands per acre, while remote North Country land may cost only a few thousand.

- High-Demand Areas: Southern NH and the Seacoast command the highest prices (often $25k–$30k+ per acre), while northern rural counties like Coös remain far more affordable.

- Key Value Drivers: Location, access, utilities, and zoning heavily influence pricing; scenic or easily buildable parcels sell at a premium, while landlocked or swampy lots sell for much less.

- Tax & Policy Environment: NH’s no-income-tax appeal is offset by high property taxes, and large undeveloped parcels may face a 10% land use change tax if converted from “current use.”

- Market Forecast: Land values are expected to grow moderately into 2026, with steady demand from telecommuters, recreation buyers, and long-term land investors.

New Hampshire Land Market Value Insights (2025–2026)

New Hampshire’s real estate market is on an upswing as of 2025, continuing into 2026. According to the USDA, the average farm real estate value (land and buildings on farms) in NH reached about $6,500 per acre in 2025, a 4.0% increase from the previous year.

This rate of growth is in line with national trends – the U.S. average farm land value hit a record $4,350 per acre in 2025 (up 4.3%) – but New Hampshire’s farmland is considerably pricier than the national average due to its location and limited supply.

In fact, New England states generally have some of the highest farmland values in the country because land often competes with other uses (residential, commercial).

Tiny Rhode Island tops the charts at about $22,500/acre and neighboring Massachusetts at $14,900/acre. New Hampshire’s average of ~$6.5k is more moderate by comparison, lower than those states but higher than farmland in Maine or the Midwest.

It’s important to note that $6,500/acre is an average across all farm land – actual market prices for sellable land can be much higher, especially for smaller parcels with development potential.

Recent market data from land listings indicate that the median price per acre of land listed for sale in NH is around $17,700.

This figure reflects that many listings are not just raw farmland; they include building lots, waterfront tracts, and other premium land that fetch a higher price per acre. The average land listing in NH is about 52 acres in size and priced around $930k, though listings range from humble woodlots to multi-million dollar estates.

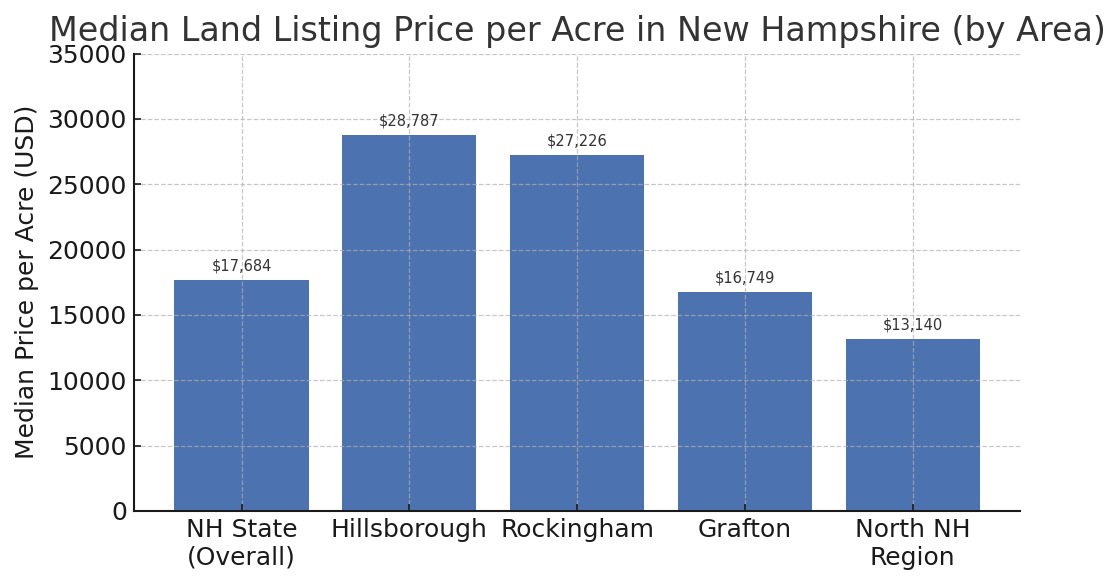

Median sale price per acre in New Hampshire by area (Land.com market data). Higher values in Hillsborough and Rockingham counties reflect demand near population centers (and the Boston metro), whereas the North Country has lower prices per acre due to its remote, rural nature. Smaller state-wide figures combine all regions.

As the chart above shows, location within New Hampshire dramatically impacts land values. Statewide, the median listing is about $17.7k/acre, but land in Hillsborough County (home to cities like Manchester and Nashua) goes for a median of ~$28,787 per acre. Likewise, Rockingham County on the seacoast (Portsmouth area) sees listings around $27,226 per acre.

Meanwhile, more rural counties such as Grafton County (in the west-central part of the state, including mountain towns) have medians closer to $16,749 per acre.

In the far north, large tracts in the “North Country” region (Coös County and northern Grafton) have a median around $13,140 per acre for listings over 10 acres. In other words, an acre of land in greater Manchester or on Lake Winnipesaukee might cost double or more the price of an acre in a quiet North Woods town.

Why are southern NH and coastal areas so much pricier? Two big reasons: proximity to population centers and limited supply.

Population Centers

Southern counties border Massachusetts – within commuting distance of Boston – and have the state’s highest populations and job markets. This creates strong demand for housing development, commercial sites, and even rural retreats for city commuters.

Limited Land Supply

At the same time, New Hampshire isn’t a very large state, and certain areas (like the seacoast) have inherently scarce land (NH has only 18 miles of coastline, making coastal property a hot commodity). Intense competition for these limited parcels drives up values.

By contrast, in the North Country there are vast stretches of forest and former industrial timberland with relatively few people around; there simply isn’t as much buyer competition, so per-acre prices remain low.

Land Use Pressure

Another factor is land use pressure.

In southern NH, an acre of land is often viewed not just for agriculture or recreation, but for building homes or businesses. The price reflects what someone could do with that land.

For example, an acre on the outskirts of Nashua might be subdivided or built into a shopping plaza, making it worth far more than an acre on a mountainside with no road.

In the words of one land market observer: “An acre in downtown Nashua is going to cost you a pretty penny more than an acre in the North Country, potentially hundreds of thousands of dollars difference”.

How Much Is 1 Acre Of Land In New Hampshire Counties & Regions?

Here is the short answer to the question how much is an acre worth: Most acres in NH sell between $10,000 and $150,000/acre, depending heavily on location, terrain, utilities, zoning, and demand. We have dedicated article for this here.

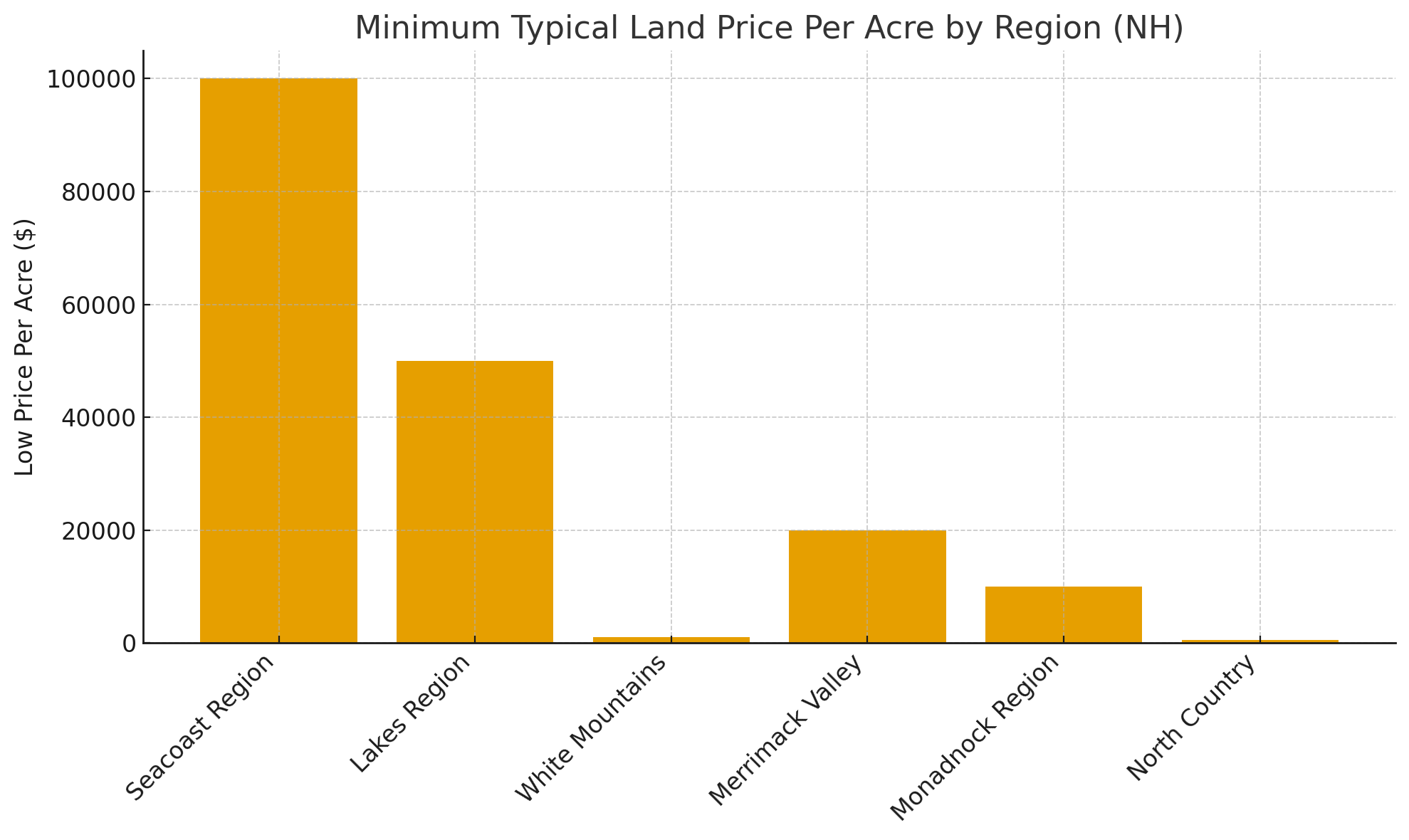

To put this in perspective, consider these rough regional price ranges for 1 acre of land in NH (as of mid-2020s):

Seacoast Region

Near the ocean (Portsmouth area), prime land can run $500,000 to $1,000,000+ per acre for commercial or residential use. Just a few miles inland, it might drop to $100k–$500k per acre for less prime sites. Coastal land is extremely scarce and in demand.

Lakes Region

Waterfront on major lakes (e.g. Lake Winnipesaukee) easily costs $200,000 to $1+ million per acre. Slightly off the water, prices fall to around $50,000–$200,000 per acre. People pay a premium for shoreline access and views.

White Mountains Region

Near ski resorts or tourist towns (e.g. Conway, Lincoln), land might be $50,000–$200,000 per acre. But in more remote mountain areas, an acre could go for as little as $1,000–$5,000 (reflecting very limited use without costly improvements).

Southern New Hampshire

Merrimack Valley (Southern Urban Corridor)

In and around cities like Manchester and Nashua, buildable lots in town can be $100,000–$500,000+ per acre. In rural outskirts of this region, more like $20,000–$100,000 per acre. This area balances urban and rural influences.

Monadnock Region (Southwest NH)

Around town centers (Keene, Peterborough) land might be $50k–$200k/acre, whereas in quiet rural parts of Cheshire County it can be $10k–$50k/acre. This region offers a mid-range price point – not as expensive as the metro counties, but higher than the far north.

Northern New Hampshire (Coös County/North Grafton)

Here lie the bargains for land.

Large tracts of forest, hunting land, or secluded camp lots can sometimes be $500–$2,000 per acre – incredibly cheap, but these often lack utilities and easy access. Buyers for this type of land are fewer (often recreational or conservation-minded), which keeps prices low.

These ranges illustrate how diverse New Hampshire’s land market really is.

The state offers everything from expensive suburban parcels to wild lands at rock-bottom prices. This diversity is driven by the state’s geography and economy. New Hampshire’s landscape is famously varied from the White Mountains (with Mount Washington as the tallest peak in the Northeast) to the Lakes Region and dense forests – and much of it remains rural.

About 80% of NH’s land area is forested (the highest percentage of timberland in the nation), so timber and conservation land is a significant part of the market.

At the same time, New Hampshire has thriving urban areas and job centers in the south, plus tourist economies around ski resorts and lakes. This mix means different parcels of land attract very different types of buyers (and thus different pricing).

Factors Influencing Land Values and Market Trends

Understanding why land is valued the way it is will help you, as a seller, position your property effectively. Here are the key factors that influence land prices and market trends in NH:

Location & Accessibility

Real estate is always about “location, location, location,” and for land this translates to where the parcel is and how easy it is to get there. Land near cities or major highways will generally be worth far more than land at the end of a remote dirt road.

For example, a tract “within 2 hours of Boston” is a big selling point – one 25-acre farm in Dorchester, NH, was marketed as “within 2 hours of Boston” to entice buyers looking for an accessible homestead or business site. Meanwhile, if a property requires a “helicopter to reach,” its price plummets (except perhaps to the odd reclusive millionaire).

Good road frontage, driveways, and year-round access can significantly boost value, because they expand the pool of potential buyers and uses.

Natural Features & Aesthetics

The presence of scenic views, water features, or unique landscape qualities can send land values soaring. Think mountain vistas, lakefronts, river frontage, or panoramic views of fall foliage, these are highly desirable.

Land listings often emphasize such features to justify higher asking prices. For instance, a listing for 36 acres in Bethlehem, NH (Grafton County) highlights “360 degree views. Ethereal sunrises and sunsets” amid the beauty of the White Mountains.

Another in Jefferson, NH boasts “stunning panoramic views of the majestic Presidential and Kilkenny Mountain Ranges” – referring to the Presidential Range (which includes Mt. Washington) and the Kilkenny Range in the North Country. Properties with waterfront (like a shore on Lake Winnipesaukee or a private pond) are especially prized, buyers will pay top dollar for a slice of a NH lake.

By contrast, an otherwise similar piece of land that’s flat or lacks views might be valued much lower. In short, if nature has blessed your land with something special, it’s a major selling point.

Allowed Uses (Zoning and Development Potential)

What a buyer can do with a piece of land heavily influences its market value. Every town in NH has its own zoning regulations and land-use rules (some towns are fairly permissive, while others are strict).

A parcel that is “buildable”, meaning it meets requirements for constructing a home (adequate road access, soil that percs for septic, not in a protected wetland, etc.) will attract residential buyers and fetch a higher price than a similar parcel that is unbuildable.

If land is zoned for commercial or industrial use near a growing area, it might interest developers or businesses, again raising value. Conversely, if the land is under conservation easement or has usage restrictions, that limits the buyer pool and lowers value.

Sellers should do some market research and advertise the development potential: e.g., “this lot is approved for a 4-bedroom home,” or “potential for subdivision into 5 lots,” or “zoned agricultural bring your farm dreams.” As one guide put it, “A buildable lot near amenities will generally be worth more than remote woodland”. So know what category your land falls into.

Parcel Size and Configuration

The size of the land and how it’s laid out also matter.

There is a bit of a paradox in land pricing: smaller parcels in populated areas often have a higher price per acre than large parcels.

For example, a one-acre lot in a town might sell for $100k (so $100k/acre), whereas 100 acres of forest in that same town might not sell for $10 million, it might go for $1M (i.e. $10k/acre).

Larger tracts often have to be sold at a bulk discount per acre, unless they can be split. Why? The pool of buyers with the means to purchase (and use) a very large tract is smaller. Many large rural parcels in NH eventually get subdivided into smaller lots for housing.

If you have a large piece of land, one strategy is to subdivide it before sale to target multiple buyers (though this requires investment in surveying, approvals, etc.). On the other hand, if your large land has one-of-a-kind value (e.g., a 300-acre trophy hunting estate), you might find that one special buyer willing to pay a premium.

The key is recognizing the per-acre value tends to increase as parcel size decreases (up to a point). Also, the shape and road frontage of the parcel can affect value – long road frontage can allow easier splits, and regular-shaped lots are easier to use than skinny land strips or landlocked backlots.

Economic and Demographic Trends

New Hampshire’s overall economy and population trends impact land demand. The state has seen an influx of new residents in recent years, partly due to people relocating from higher-cost states (or from cities during the remote-work boom).

NH’s attractive tax situation, no income tax on wages and no general sales tax, is a draw, especially for folks from neighboring Massachusetts (which has both income and sales taxes).

This in-migration has fueled demand for housing and thus land for homes. For example, Hillsborough County’s strong job market (median worker income ~$53k, low unemployment ~3.3%) means more people looking for houses and pushing developers to buy land.

Tourism

Another economic driver is tourism: areas that cater to tourists (ski areas, lake towns) have extra demand for vacation home lots, cabins, and related commercial development (like restaurants or campgrounds).

New Hampshire’s outdoor recreation sector such as skiing, hiking, and leaf-peeping in autumn, has been growing and “continues to attract visitors and support local businesses”. This keeps land values in those scenic areas healthy. On the flip side, if an area loses a major employer or sees population decline, land demand can soften.

Competing Land Uses & “Alternative” Values

Farmland and open land in NH aren’t just eyed by farmers or home-builders; increasingly, there are competing uses that influence land values.

Renewable energy

One is renewable energy development, for instance, companies looking for sites for solar farms or wind turbines.

The American Farmland Trust notes that in the Northeast, solar energy developers are leasing or buying land, which “puts upward pressure” on prices in some areas because it’s a new source of demand.

Investment (hedge against inflation)

Another factor is investors who see land (especially farmland or timberland) as a safe investment and hedge against inflation. Low interest rates in the early 2020s led some investment funds to pour money into land.

Even though rates have risen since (which can cool real estate, as borrowing to buy land gets more expensive), land is still considered a tangible asset that holds value. Additionally, NH’s land has intrinsic value for conservation, land trusts and government sometimes buy land to protect wildlife or water resources, and they will pay fair market value, effectively taking some supply off the market and supporting prices for remaining land.

Tax and Regulatory Environment

We touched on taxes, but from a seller’s perspective, two things stand out: property tax and the Current Use program.

New Hampshire’s high property tax (averaging 1.77% of property value annually) means holding land can be costly for owners, especially if it’s not generating income.

This sometimes motivates landowners to sell (e.g., an out-of-state owner of a second property might decide the yearly taxes are too much). Many large landowners enroll in Current Use, a program that dramatically lowers the tax on undeveloped land by assessing it at its “farm or forest” value rather than full market value.

This is great while you own the land (taxes stay low), but if you or your buyer intend to develop or change the use of the land, the town will levy a Land Use Change Tax (LUCT) penalty. This penalty is 10% of the market value of the portion of land removed from current use. It’s essentially paying back some of the tax savings.

Sellers and buyers can negotiate who pays this 10%, but often it falls on the seller at closing (with the closing agent holding aside 10% of proceeds until the town issues the bill).

Practical tip: if you’re selling land that’s in current use, be sure to factor this in and discuss it with the buyer. It might be advantageous to sell to someone who will keep it as open land (no penalty), or at least be ready for the penalty if it will be developed.

Aside from taxes, local regulations like subdivision requirements, septic rules, or shoreland protection laws (for waterfront parcels) can affect how attractive your land is. Being knowledgeable about these and having any necessary permits or studies done can make your land more marketable.

Environmental and Social Trends

Finally, broader trends can create niche markets in land. For example, the interest in sustainable farming and permaculture has some buyers specifically seeking land to start organic farms or homesteads.

One notable NH property on the market was the former "D Acres Permaculture Farm & Educational Center" (25 acres in Dorchester, NH). It was advertised as an “adaptive reuse opportunity”, meaning the new owner could continue the farm, or turn it into something else like a farm-to-table restaurant, an event venue, or a family compound.

This shows how sellers are pitching land with existing infrastructure to creative new uses.

Similarly, the “green building” movement means some buyers want land to build eco-friendly homes (solar-powered, off-grid cabins, etc.). If your land has features suitable for that (southern exposure, a good water source for sustainability, ample timber to potentially use for building), it’s worth mentioning.

Adaptive reuse in a broader sense can also refer to repurposing old buildings on a property – for instance, an old barn could become a boutique shop or wedding venue on the right piece of land, which can intrigue certain buyers.

Keep an eye on trends like glamping, tiny house communities, or regenerative agriculture – while niche, these can affect how you market a unique piece of land.

Market Outlook for 2026

Looking ahead, what can landowners expect in 2026? While we don’t have a crystal ball, current data and expert market analyses provide some guidance:

Continued But Calmer Price Growth

The explosive land price increases seen in 2021–2022 (when some farmland shot up 10–20% in value in one year) have leveled off. As of 2025, growth is modest and steady, around 4–5% per year for farm real estate.

This suggests that heading into 2026, land values in NH will likely continue to rise, but at a moderate pace. High interest rates (compared to early 2020s) have cooled some speculative buying, and the market has largely absorbed the pandemic-era surge of city-dwellers seeking rural retreats.

No crashes are anticipated, as inventory (supply of land for sale) remains relatively limited and demand for quality New Hampshire land remains high. But sellers should be aware that buyers are a bit more price-sensitive than they were when loans were cheap.

Regional Hotspots Persist

We expect southern NH and the Lakes Region to remain hotspots. These areas have strong economies or desirable amenities that will keep drawing buyers. For example, as long as the Greater Boston area thrives, nearby NH towns will be attractive for commuters or businesses (thanks in part to NH’s lower taxes).

The Seacoast, with its blend of high-paying jobs in Portsmouth and beach/coastal lifestyle, should also stay in high demand. Hillsborough County (Manchester/Nashua) and Rockingham County (coastal) consistently have among the most land searches and sales in the state.

On the Land.com network, those New Hampshire counties rank high in search trends, indicating buyer interest. We also see Grafton County ranking #1 in number of land listings searches, which likely ties to its large size and inclusion of both Dartmouth College (upper valley region) and White Mountain recreation towns, two very different drivers for land sales (college-related growth vs. vacation homes).

The North Country may see a slight uptick in interest too, as remote work enables some folks to live further off-grid.

But generally, price gaps between regions will persist; there’s no sign that cheap land in Coös will suddenly shoot up to southern NH levels absent a major development (like if a large employer moved there, which isn’t on the horizon).

Economic Factors

New Hampshire’s economy entering 2026 is relatively strong, low unemployment, growing wages, and robust state finances. This underpins real estate demand.

One thing to watch is the housing shortage: NH, like much of the country, has had a tight housing market with low inventory. This has kept home prices high. If this continues, developers will keep looking for land to build new homes.

However, construction costs are also high, so not every piece of land is profitable to develop. Interest rates are a big factor too: higher rates mean higher mortgage costs, which can price out some buyers, especially for discretionary purchases like second-home lots or recreational parcels.

If rates remain elevated in 2026, land sales might take longer and buyers might negotiate harder on price. Conversely, if rates ease, we could see another burst of activity as more buyers jump in.

Legislation and Policy Changes

There don’t appear to be major state law changes looming that would drastically alter the land market. One item of note at the federal level was the status of the Conservation Reserve Program (CRP), a program paying landowners to keep land fallow for conservation. It has some impact on farmland supply nationally, but in NH it’s not as widely used as in big farming states.

Locally, there have been ongoing discussions about zoning reform to allow more housing (to address the shortage). If towns start loosening zoning to allow higher density or multi-family units, some land parcels could become more valuable (since they could host more homes).

Sellers should stay informed on their locality’s plans – sometimes a zoning change can significantly boost land value by increasing what can be done on it. Also, watch for any updates to the Current Use program; it’s politically popular in NH, so major changes are unlikely, but incremental adjustments to assessment rates happen.

Environmental and Social Trends

Renewable Energy

The push for renewable energy could mean more proposals for solar farms in NH. Already, some landowners are leasing land for solar arrays (e.g., a 20-acre sunny field could earn income that way).

If you have open, flat land, 2026 might bring opportunities to sell or lease for energy projects.

Rural Living

On the social side, interest in rural living remains higher than pre-2020 levels, many people experienced remote work and liked it. New Hampshire offers an appealing environment for those seeking a mix of nature and accessibility.

Towns with good internet infrastructure and attractive surroundings (for example, the Upper Valley area around Hanover/Lebanon, or towns like Peterborough/Keene) may see increased demand for land as people build homes outside the big cities.

Permaculture & Homesteading

Another trend is permaculture and homesteading: as mentioned, some buyers specifically want land to cultivate, raise animals, and live sustainably.

The presence of established community farms and educational farms (like D Acres in Dorchester, or smaller permaculture homesteads) is encouraging that movement. If you’re selling farmland or acreage, tapping into that market (advertising on homestead forums or highlighting organic potential) could yield results.

Overall, the 2026 outlook for NH’s land market is positive. It’s a seller’s market in many parts of NH, but not an overheated one. Land is appreciating at a healthy single-digit rate.

Sellers who price correctly and market effectively should find buyers, especially since New Hampshire continues to be an attractive state to live, work, and play in. Just remember that land often requires the right buyer – it might take time to find them, but they are out there.

Tips for Selling Land in New Hampshire

Selling land is different from selling a house. Land buyers evaluate properties with a unique set of criteria, and often the market is less fluid than the housing market. Here are some actionable tips for land sellers in New Hampshire:

- Know Your Land’s Value – Research comparable sales, understand your land’s unique features, and price realistically to avoid overpricing or underselling.

- Prepare the Property – Clear access, mark boundaries, and make the land easy for buyers to walk and visualize.

- Have Key Information Ready – Provide surveys, zoning details, perc tests, and disclose any known issues upfront to build buyer confidence.

- Highlight Features & Potential Uses – Market the land’s best attributes and describe its highest and best use clearly in listings.

- Understand Your Buyer – Tailor your marketing to the right audience, whether it’s farmers, homebuilders, investors, or recreational buyers.

- Be Patient and Strategic – Land often takes months to sell, so adjust pricing, timing, or marketing if interest is low.

- Stay Flexible in Negotiations – Consider options like owner financing, subdividing, or negotiating terms that appeal to more buyers.

- Handle Legal & Tax Matters Early – Address title issues, Current Use penalties, or tax implications before listing to avoid delays.

- Use Professionals When Needed – An experienced land agent or attorney can help you price, market, and navigate NH’s land-sale regulations.

For the full breakdown, see our complete How to Sell Land in New Hampshire guide.