Key Takeaways

- Utah’s land market remains strong but is cooling, with price growth slowing after years of rapid increases driven by population and economic expansion.

- Land values vary drastically by region and land type, with urban buildable lots commanding premiums while rural and agricultural land remain far more affordable.

- Key value drivers include zoning, utilities, water access, and Utah’s limited supply of private land, all of which heavily influence price.

- Sellers in 2026 should price strategically using comps, highlight unique land features, and consider varied selling methods while staying aware of tax implications like 1031 exchanges and Greenbelt rollback taxes.

If you want to sell your land in Utah for cash, it's good to know that the Beehive State's land market is entering 2026 on strong footing, marked by high demand and rising values, yet also showing signs of moderation.

The Beehive State’s economy and population have been booming – Utah is among the fastest-growing states in the nation, with over 60,000 new residents added recently and a growth rate around 1.6% per year.

This surge of people and businesses has fueled intense demand for land of all types: from residential building lots along the bustling Wasatch Front, to farmland in rural valleys, to recreational acreage near Utah’s famous mountains and deserts.

However, 2024–2025 brought a more balanced market compared to the frenzy of the early 2020s. Higher interest rates, slowing in-migration, and economic uncertainties have cooled the pace of price increases.

For example, Utah’s median home price hovered around $547,700 in late 2024 – essentially flat from the year before – a stark contrast to the double-digit annual jumps seen in 2020–2022.

Land prices tend to follow these housing trends. Industry experts note that land values are still climbing, but more slowly than in previous years. In short, Utah’s land market remains robust but is no longer overheated – welcome news for buyers, while still rewarding sellers with historically high values.

In this guide, we’ll break down Utah’s land market trends and provide an outlook for 2026.

We’ll examine different land categories (agricultural, development, recreational), regional market differences across the state’s diverse landscape (from the Wasatch Range to the red rock deserts), and key factors that influence land value such as zoning, infrastructure, and population growth.

Importantly, since this guide is for land sellers, we’ll also offer actionable tips on how to price and market land, and how to navigate taxes and regulations when selling property.

Whether you own a farmland in Sanpete County, a suburban lot in Utah County, or a mountain acreage near Park City, understanding these trends will help you make informed decisions in 2026.

Utah Land Market Overview

Utah’s land ownership breakdown: only about 26% of land in Utah is privately owned (the remainder is mostly federal and state public land), which limits supply and drives competition for private property.

Utah’s land market has unique characteristics that set it apart.

One of the most fundamental factors is ownership and geography. A vast majority of Utah’s 84,000 square miles is public land – about 64% federal and 10% state-owned – leaving only roughly one-quarter of land in private hands. This means supply of land for sale is inherently limited, particularly in desirable areas.

Additionally, Utah’s striking landscapes vary from the Wasatch Mountains in the north to arid plateaus and basins in the south. This diversity creates very different sub-markets: a tract of raw land with mountain forest and stream access near a ski resort has a completely different value (and buyer pool) than an equally sized tract of barren desert land in the remote southeast.

In short, location and land type are paramount in Utah’s market.

Recent trends

Over the past few years, virtually all types of land in Utah saw value appreciation, although the hottest growth has started to cool.

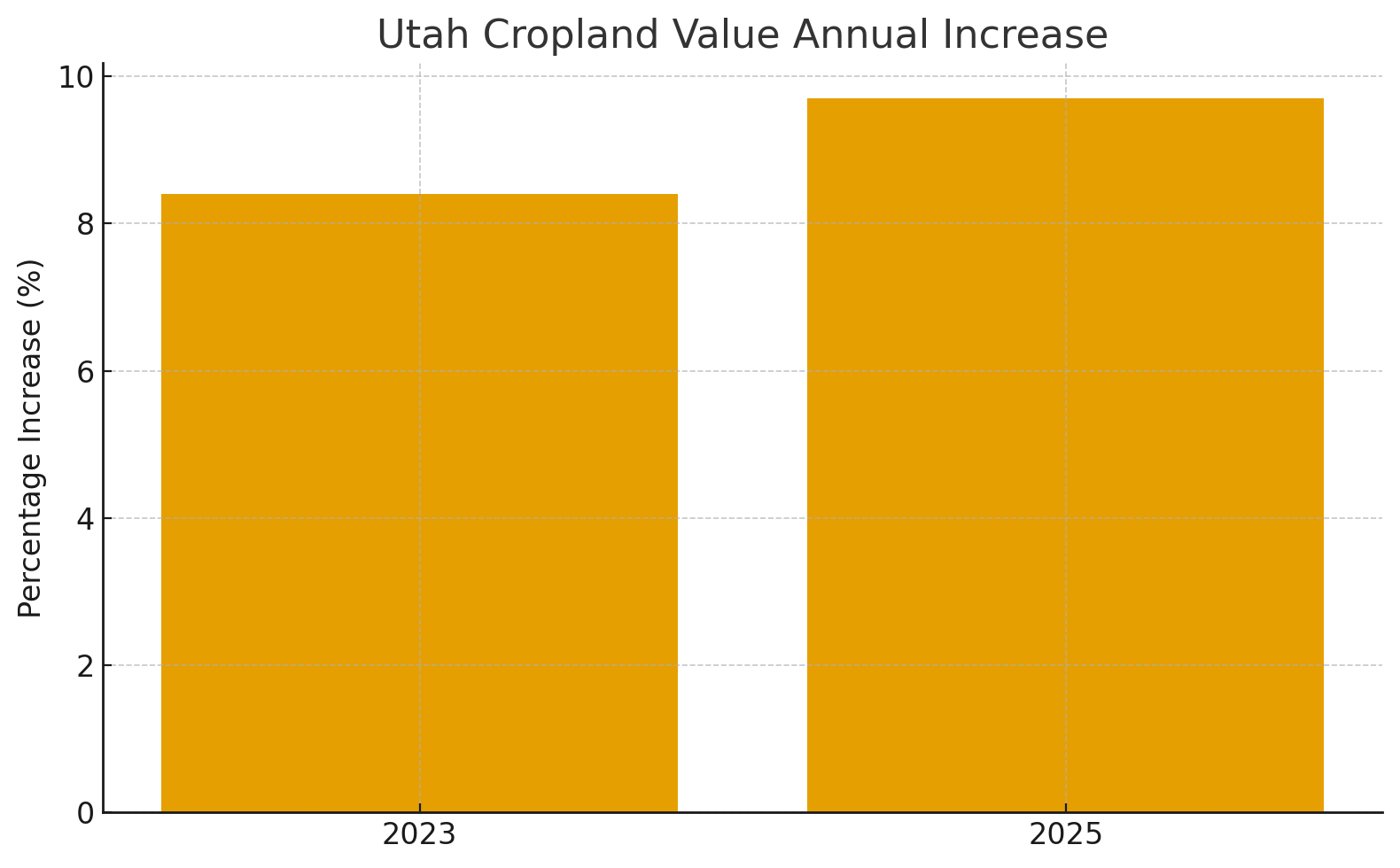

The Utah Association of Realtors reported that the median price per acre of undeveloped land statewide jumped 12% in 2023 compared to 2022, reflecting the strong demand coming out of the pandemic era. Farmland and agricultural real estate have also hit record highs – USDA data show Utah’s average farm real estate value (land and buildings) reached about $3,040 per acre in 2025, up from roughly $2,770 the year before.

In fact, Utah led all states with a 9.7% annual increase in cropland values in the latest report, a surge attributed to both higher farm income and competition for land (including non-farm development pressure).

At the same time, housing-driven land demand in urban areas has been extremely robust, though it plateaued in 2023–2024 as interest rates climbed. Utah’s median single-family home price, which soared by 25% in 2021 and another 14% in 2022 amid a buying frenzy, leveled off by late 2024.

This stabilization indicates that residential land prices – which were skyrocketing along with home prices – have also steadied.

High mortgage rates have cooled some buyer enthusiasm, and more land listings are staying on the market longer (the average Utah land listing spent 57 days on market in 2025, up from the frenzied quick sales of 2021).

Nonetheless, overall land values remain very high historically, and sellers still largely hold the advantage in most parts of the state due to the persistent imbalance of demand vs. limited supply.

Outlook for 2026

Looking ahead to 2026, Utah’s land market is expected to remain strong but not skyrocketing.

The state’s population and economy continue to grow, underpinning long-term land value increases. Utah’s population rose to about 3.5 million in 2025 and is projected to reach 5.6 million by 2065 (a 66% increase).

This “population boom,” as the University of Utah’s Gardner Institute calls it, means more people will need housing, more businesses will need sites, and even recreation and tourism (a major Utah industry) will spur interest in land near parks and resorts.

These fundamentals point to ongoing demand. On the other hand, economic “fog” and caution have entered the market nationwide – high inflation and interest costs, plus uncertain migration trends, are making buyers and developers more measured.

The consensus for 2026 is moderate growth: land prices likely rising in the low single digits percentage-wise, rather than the double digits of a couple years ago, assuming interest rates ease slightly and the economy avoids any major downturn.

Sellers should not expect the wild bidding wars of 2021, but they can expect a broad base of interested buyers if they price their land appropriately for this new normal.

Land Market Trends by Type of Property

Not all land is equal – in Utah, different categories of land (farmland, residential, commercial, recreational) follow distinct market dynamics. Below we break down the trends for key land types that a seller should know:

Farmland and Ranch/Agricultural Land

Agricultural land in Utah, including farmland and ranch acreage, has historically been priced much lower per acre than land in urban uses, due to its remote locations and reliance on agricultural income.

Cheap, But Becoming More Valuable

That remains true, but even this sector has seen notable appreciation recently. As of 2025, the average value of farm real estate in Utah (land and farm buildings) is about $3,040 per acre. This is well below the U.S. average (~$4,350/acre) and a fraction of values in states like Iowa (~$9,800).

Utah’s farm and ranch lands are relatively cheap partly because much of it is semi-arid pasture or desert – less intensively productive and with less development pressure than prime Midwest cropland. For example, grazing rangeland in eastern Utah might sell for under $1,000/acre in some cases.

That said, Utah’s agricultural land is becoming more valuable. In 2025, Utah saw the nation’s highest cropland value increase, up 9.7% year-over-year. This follows a trend of consecutive annual rises – one analysis noted an 8.4% jump in Utah farm values in 2023 alone.

The drivers include strong commodity prices in 2021–2022 (which boosted farmers’ incomes and ability to purchase land), low interest rates earlier (making land an attractive investment), and investor interest in farmland as a stable asset.

Future Development Factor

In Utah, another factor is that some farmland on the fringes of cities is being bought for future development – even if still farmed today, its market value starts to reflect potential for housing or industrial use, bidding up the price.

For instance, farmland in the path of growth along the Wasatch Front can fetch $20,000 to $50,000 per acre instead of the $5,000–$10,000 it might be worth for purely ag use.

The Importance of Water and Irrigation

Geographically, the highest farm and pasture values are in northern Utah counties where irrigation water and productivity are better (Cache, Weber, Utah County’s remaining farms, etc.), while the lowest are in dry southeastern areas.

According to Utah’s Farmland Assessment reports, in 2025 some counties (Weber, Washington, etc.) saw slight increases in productive land values, whereas a few heavily urbanizing counties like Salt Lake County actually saw small declines in farm land values for tax purposes.

This could be because marginal farming areas are being taken out of production or because commodity prices leveled off. Still, any declines were modest (e.g. Salt Lake County -$16/acre recommended).

Overall, farmland sellers in Utah in 2026 can expect solid pricing, with typical farm acreage often selling in the range of $2,000 to $10,000 per acre in central and northern Utah, and $500 to $2,000 in more arid regions.

Large legacy ranches with thousands of acres (especially if they include water rights or hunting land) can command premium prices as well, sometimes attracting out-of-state investors or recreational buyers looking for a slice of the West.

One critical consideration for agricultural land in Utah is water. Water is life for farming, and much of Utah faces moderate to severe water scarcity. About 65% of Utah’s developable land has water limitations (drought, limited groundwater, etc.). Land with secure water rights (e.g. irrigation shares from a canal or well rights) is far more valuable for farming and even for future subdivision. A parcel with no water source in a dry area might only sell to someone for grazing or off-grid use at a low price.

Sellers should be prepared to document and possibly sell water rights with the land – often water rights are a separate property right in Utah, but tying them to the land sale can greatly increase appeal to buyers (and sometimes is required for building).

Farmland Assessment Act (Greenbelt)

Also note that Utah’s Farmland Assessment Act (Greenbelt) allows farmland to be taxed at a low agricultural rate; if you sell land for development and it’s removed from agricultural use, the county will impose a rollback tax for the previous 5 years of tax savings.

This is usually a minor amount relative to sale price, but it’s something to be aware of (often handled at closing, with either the seller or buyer paying the rollback – negotiable in the deal).

Residential and Development Land

The category of residential development land – which includes city lots, suburban subdivisions, and raw land intended for housing – is perhaps the hottest segment of Utah’s land market.

Utah’s population growth (about 1.7% annually in Utah County, for example) has created a housing shortage in many communities. The Wasatch Front metro area (from Ogden down through Salt Lake City to Provo) is the state’s urban core and has seen aggressive demand for building lots.

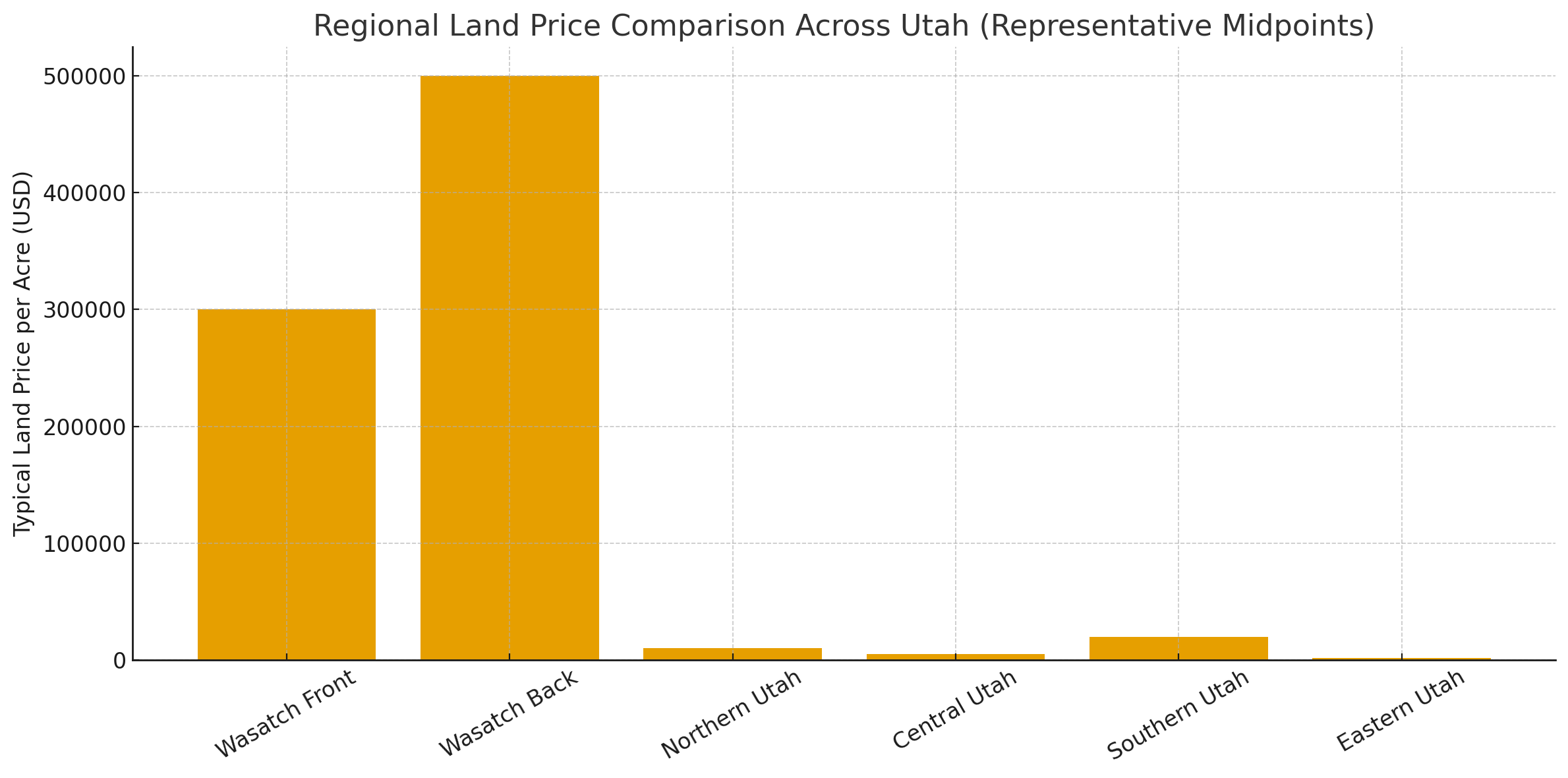

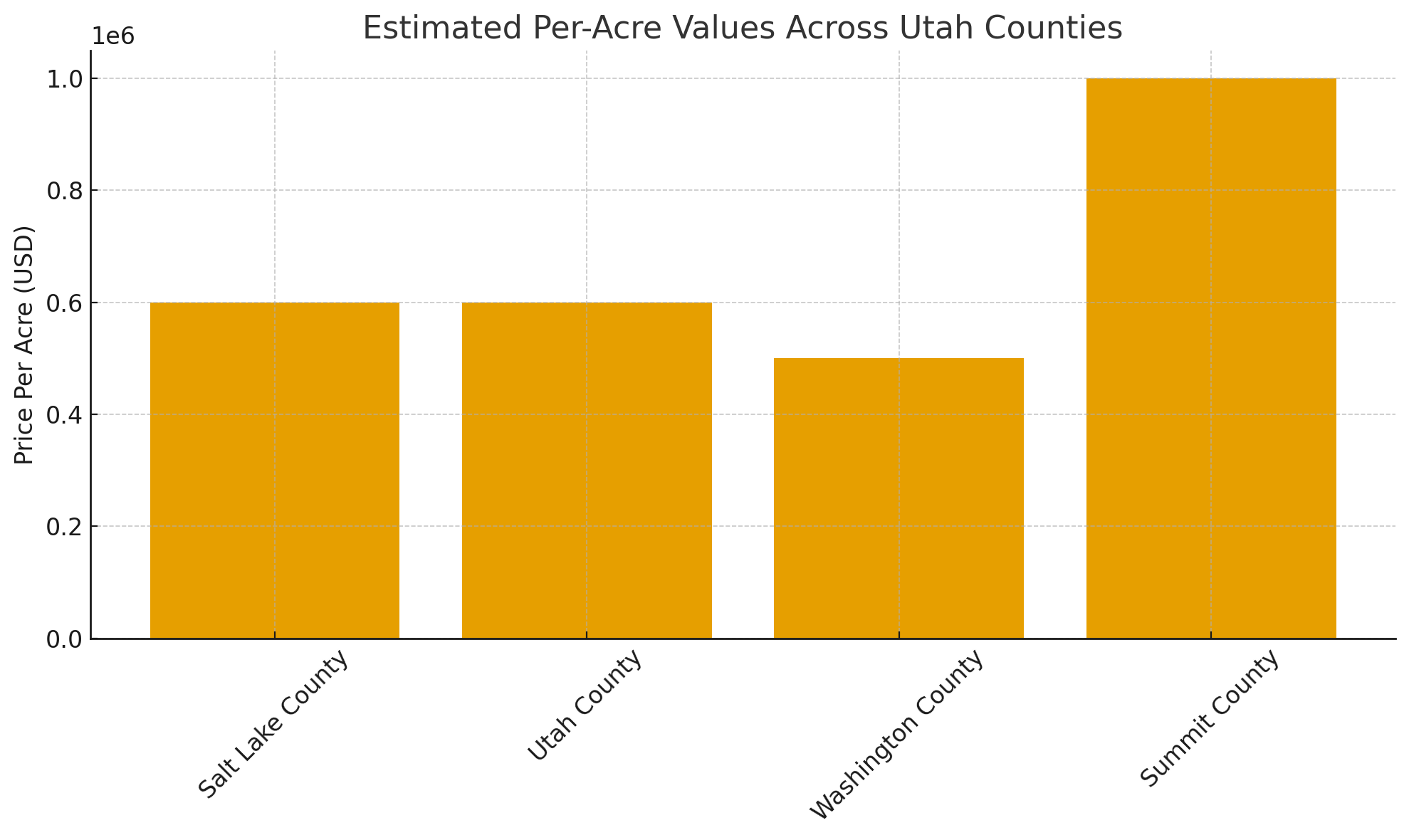

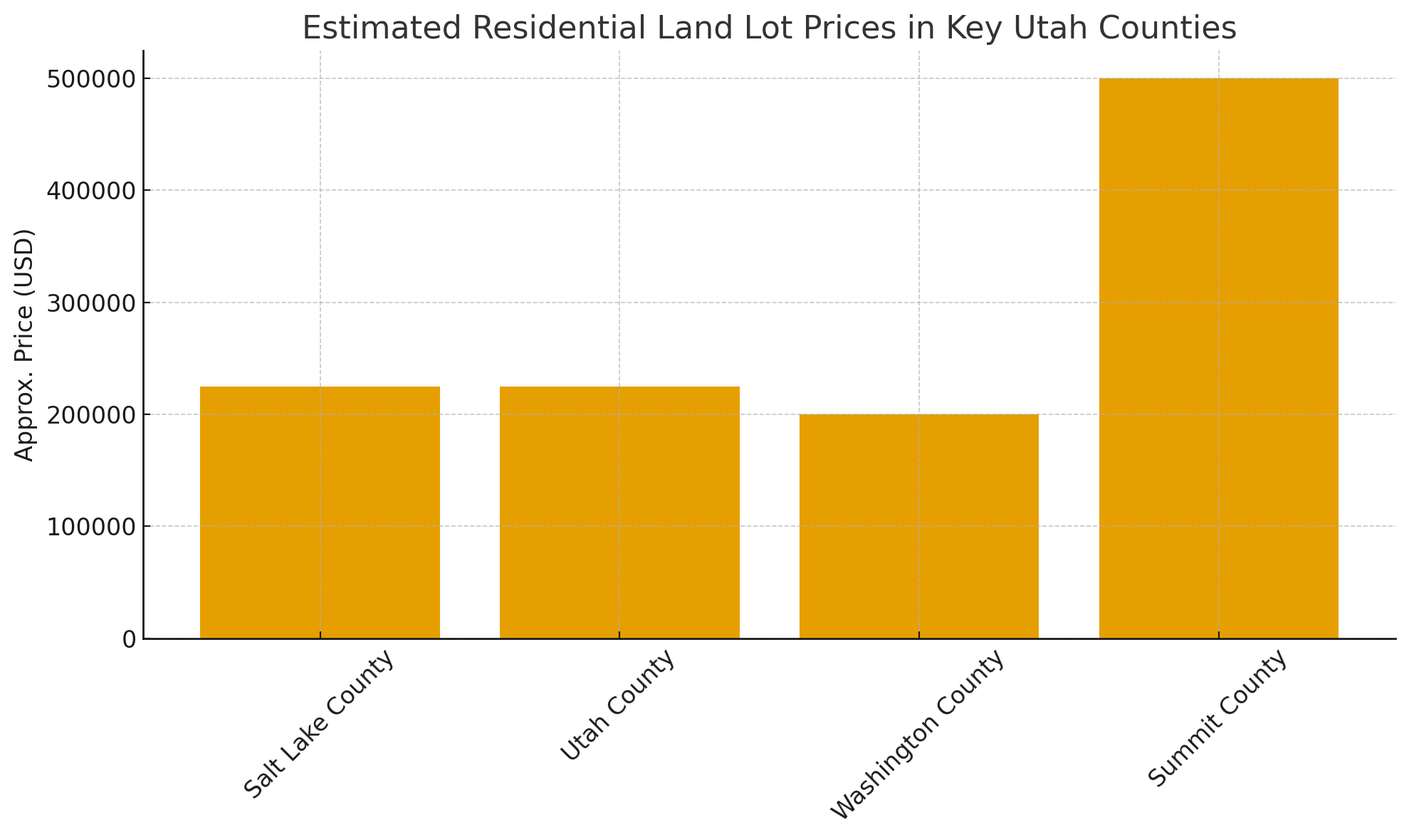

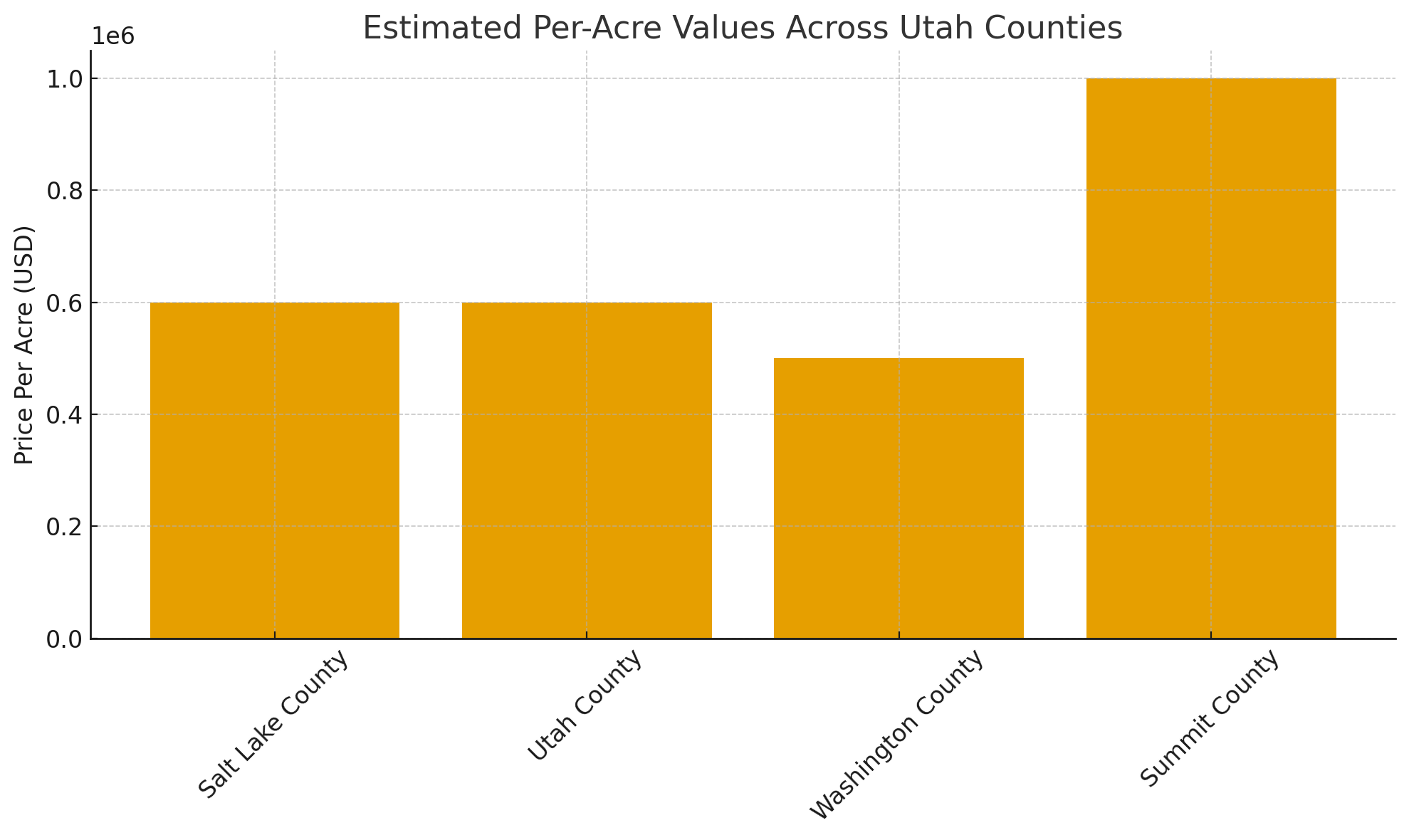

It’s not uncommon for a simple single-family “land lot” in a suburb (often about a quarter-acre in size) to cost well into six figures. For instance, in Salt Lake County or Utah County, urban residential lots can run $150,000 to $300,000+ each, which translates to $600,000+ per acre in prime locations when subdivided.

Even on a per-acre basis, an acre of land in a decent suburban neighborhood can easily be $500,000 or more because it might accommodate 3–4 home lots. In Salt Lake City proper, or upscale areas, an acre could exceed $1 million in value if zoned for multiple homes or apartments.

This trend has put Utah in the top 10 most expensive housing markets nationally. In 2024, median home prices were roughly $548k statewide (and significantly higher in some counties).

While home prices plateaued in 2024 due to affordability pressures, they remain “seriously unaffordable” for many residents in major counties. Because of this, we are seeing higher-density development gain traction: demand for townhomes and apartments is rising as single-family homes become less attainable.

For landowners, this means parcels zoned or suitable for multi-family buildings (e.g. an apartment complex or a townhouse community) are very attractive to developers. Land that might have held a few houses could be much more valuable if re-zoned for, say, a 4-story apartment building.

As the Gardner Institute reports, Utah’s residential construction mix has shifted, with fewer single-family permits and more multi-family units in recent years. Sellers should understand their zoning: if your land can be up-zoned or already allows higher density, emphasize that to fetch top dollar.

Regionally, Utah County (home to Provo, Orem, Lehi) is a hotspot – it was the fastest-growing county in Utah, adding ~21,000 people from 2023 to 2024. This growth is fueling sprawl into places like Eagle Mountain, Saratoga Springs, and Santaquin, where large tracts of former farmland are being subdivided.

In northern Utah, Davis County and Weber County (Ogden area) also have active housing markets, though they are more land-constrained between the mountains and Great Salt Lake.

Washington County around St. George in southern Utah is another high-growth area – popular for retirees and remote workers – with many master-planned communities emerging, pushing land prices up in the St. George metro (residential lots there often cost $100k–$300k each).

In resort towns like Park City (Summit County) or Heber City (Wasatch County), residential land is extremely pricey due to luxury home development and second-home buyers. It’s not unusual for an acre in Park City to exceed $500,000 (and that could be much higher if near ski slopes).

One thing to note for 2026: interest rates. High mortgage rates (which hovered in the 6–7% range in 2024–25) have made it more expensive for developers to finance projects and for end-buyers to purchase homes. This has a bit of a chilling effect on land acquisition for development – builders have become more cautious, sometimes even walking away from land deals if they think they can’t sell the homes profitably at current interest rates.

The number of residential building permits in Utah dropped in 2024 to the lowest in a decade. Thus, while demand is there, some land may not sell as instantly as it did in the frenzy years. Sellers of development land should be prepared for potentially longer marketing times or offers with conditions (like option agreements where a developer ties up the land for a year while pursuing city approvals).

On the positive side, many developers and investors still have cash ready to deploy – in fact, real estate surveys show the appetite for buying is returning as prices stabilize. If interest rates begin to ease in 2026 (and some forecasts predict modest rate declines), it could re-energize the development land market and bring a new wave of buyers looking to secure lots for the next building cycle.

Recreational and Rural Land (Cabins, Second-Home, and Miscellaneous Land)

Beyond farms and subdivisions, Utah has a significant market for recreational land – properties purchased for enjoyment, hunting, fishing, ATV riding, or as second homes/cabins.

These tend to be in the mountainous or desert scenic areas of the state. Their value is tied less to income or development potential, and more to the amenities and beauty of the land (think views, adjacency to public lands or trails, and unique features like rivers or red rock formations).

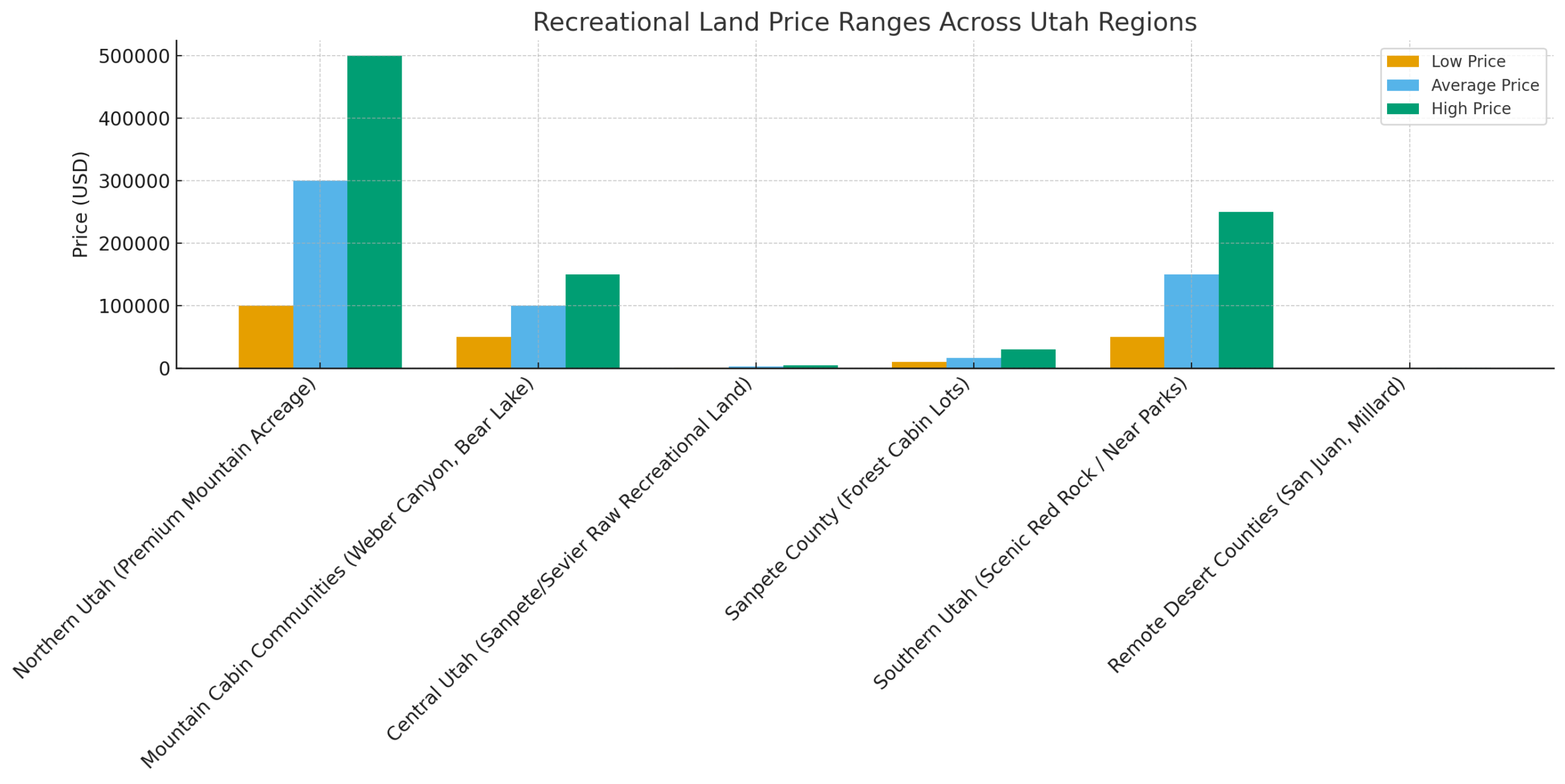

In northern Utah, for example, mountain acreage in the Wasatch Range or Uinta Mountains that offers privacy and views might sell at high prices to wealthy buyers wanting a getaway. Data indicates “mountain getaways” in northern Utah can run $100,000 to $500,000+ per acre if they are premium locations with ski access or lake views.

A small lot (1–5 acres) in a mountain cabin community (like those in Weber Canyon or around Bear Lake) might be $50k–$150k total, whereas larger plots near Park City or Sundance are much more. In central Utah counties (Sanpete, Sevier, etc.), recreational land is more affordable: one might find forested cabin lots or hunting land for $1,000 to $5,000 per acre if it’s fairly raw and without utilities.

For instance, Sanpete County’s mountainous east side has many 5- to 20-acre cabin lots that might list around $10k per acre; LandWatch data shows the median price per acre of listings in Sanpete is about $16,940 (though this skews higher due to some small premium listings).

Southern Utah’s recreation land includes areas near national parks and monuments. Zion National Park and Moab (Arches/Canyonlands) come to mind – land near these tourism hubs often gets marketed for eco-lodges, RV parks, or vacation homes. Prices there have risen with Utah’s booming tourism. Scenic parcels in red rock country or near lakes can go for tens of thousands per acre.

One resource notes that in southern counties like Kane or Washington, a property with “postcard-worthy views” might fetch $50k–$250k per acre. Meanwhile, generic desert land without special features remains cheap: in remote San Juan or Millard County, you might still buy an acre of raw desert for under $1,000 if it’s way off the grid.

Such land often appeals to niche buyers (like off-grid homesteaders or ATV enthusiasts). Volume of sales is lower here, but the market exists.

One trend to watch is infrastructure and access in these rural lands.

The extension of utilities or roads can change a recreational parcel’s value drastically. For example, if a new paved road or highway interchange is built near a once-isolated area, suddenly that land is more accessible (potentially spurring development interest).

Conversely, areas facing environmental restrictions (such as being locked by protected federal lands or lacking any legal access) will see limited value growth.

Utilities are a big selling point – land already connected to power or city water is much more desirable for building a cabin or home than land where the buyer would have to pay to extend lines or drill a well. Sellers should highlight if their land has any utility hookups or water rights; if not, price accordingly.

Also worth noting: some recreational land buyers look at the income potential from things like short-term rentals (Airbnb cabins), hunting leases, or even future conservation easements.

Utah’s outdoor attractions ensure there’s interest in land for tourism (like setting up campgrounds or ATV parks). If your land is in a high-traffic recreation area, it could be marketed not just for personal use but as an investment for someone to develop tourism facilities.

On the flip side, conservation groups also purchase Utah lands to preserve open space, sometimes paying competitive prices especially if the land borders national parks or critical wildlife habitat.

In summary, the recreational/rural land segment is highly variable – “location, location, location” truly rules here.

A few acres by a ski resort town can be worth millions, while a few acres of sagebrush in the basin might be a few hundred bucks. As a seller, understand what category your land falls into and who your likely buyer is (wealthy second-home seeker vs. local farmer vs. speculator), and price it in line with similar sales in that niche.

Regional Market Insights Across Utah

Utah’s regions each have distinct land market conditions. Let’s break down some specifics by region and county, as this can help land sellers gauge local trends:

Wasatch Front (Northern Urban Core)

This includes Salt Lake County, Utah County, Davis County, and Weber County – home to the majority of Utah’s population and economic activity. Here, land is in highest demand and shortest supply.

The Wasatch Front valley is hemmed in by the Wasatch Range mountains to the east and the Great Salt Lake or Utah Lake to the west, creating a natural limit on buildable land. As such, land values are generally highest in the state.

A small residential lot in a city like Draper or Bountiful can easily cost several hundred thousand dollars. A larger tract (if you can find one) near the edges of the built-up area could attract developers for suburban housing or commercial use.

Utah County (around Provo-Orem) in particular has been booming – it led the state in numeric population growth, with a 3% jump in one recent year. That growth translated into many new subdivisions in cities like Lehi, Saratoga Springs, and Spanish Fork. Even some traditionally rural pockets of Utah County (e.g. Cedar Valley, west of Utah Lake) have seen land rezoned and sold for large master-planned communities.

Salt Lake County, being more built-out, has less vacant land left, so often redevelopment plays (buying older properties to tear down and build anew) are common – but if you do own raw land in Salt Lake County, it’s quite valuable due to rarity.

Note that Salt Lake City proper and environs also drive demand for industrial land (warehouses, data centers, etc.), especially near the airport and freeway corridors. Industrial land prices have climbed with the rise of e-commerce and the planned inland port project – if your land has favorable industrial zoning or transport access, that’s a key selling point.

Wasatch Back and Mountain Resorts

Just over the mountains from Salt Lake are areas like Wasatch County (Heber City/Midway) and Summit County (Park City). Often called the “Wasatch Back,” these areas have transitioned from rural to upscale in the past two decades. Wasatch County is actually projected to be the fastest-growing county in Utah long-term, with ~1.9% annual growth expected for decades.

It still has considerable open land (farms, ranches), but developers from Park City and Utah County are buying up parcels for new housing (e.g., the Heber Valley is seeing large new subdivisions and even proposals for annexations).

Land values here have risen accordingly; for instance, a 20-acre farm near Heber might now be priced not just on its farming value but on its potential to become a neighborhood of homes.

Park City, on the other hand, is a mature high-end market – land there is extremely expensive. Ski-in/ski-out lots or estates in Park City can command prices in the millions of dollars for just an acre or two.

Park City area also has many instances of mergers and acquisitions in real estate – large development companies or investment firms acquiring land for resort expansion or luxury projects. If you’re a landowner in these resort areas, consider marketing nationally/internationally, as buyers could be affluent individuals or corporations (e.g., a ski resort operator might buy land to add lifts or amenities; or a celebrity might buy a ranch for a private retreat).

Northern Utah (Cache, Box Elder, etc.)

This region includes Cache Valley (Logan) and surrounding counties like Box Elder, Rich, and Morgan. It’s a mix of agricultural communities and small towns, with some growth around Logan (Utah State University) and Brigham City/Perry, etc. Land here is cheaper than the Wasatch Front, but values are climbing as people look for affordable alternatives not too far from Salt Lake.

For example, Cache County farmland averages in the mid thousands per acre. According to LandBoss, in Cache/Box Elder, typical farmland might be $5,000–$15,000 per acre, residential lots $50k–$200k per acre, and mountain recreational land $100k–$500k per acre (for prime view sites).

Morgan County, just east of Ogden, has seen notable interest because of its scenic appeal and relative proximity – large ranches there sometimes get purchased for luxury home development. Box Elder County (west of Brigham City) remains quite rural, but even there, projects like a new rocket booster plant or potential infrastructure expansions (rail hubs, etc.) can cause spikes in land prices in select areas.

Landowners in these northern counties should watch for any zoning changes or big employers moving in (for instance, Facebook built a data center in Eagle Mountain, and other tech or manufacturing companies are scouting northern Utah for large land buys – these corporate procurements can lead to lucrative sales if you happen to own the right parcel).

Central Utah (Sanpete, Sevier, Juab, etc.)

Central Utah is more sparsely populated, with a traditionally agricultural economy. Counties like Sanpete and Sevier have a lot of farmland and grazing land. Historically, land here was very cheap (a few hundred dollars per acre for range in the west desert, maybe a couple thousand for good farmland).

In Central Utah counties, farmland ranges about $2,000–$10,000/acre, rural home sites $10k–$50k/acre, and raw undeveloped acreage (especially in remote spots) as low as $1,000–$5,000 per acre. We’ve seen modest increases due to people relocating for a quieter rural lifestyle and some spillover from expensive Wasatch Front housing (e.g., telecommuters or retirees moving to Sanpete County for cheaper land).

Sanpete County, for example, offers mountain views and a lower cost of living about 1.5 hours from Salt Lake – land listings there currently have a median price ~$16k/acre, and an average lot for sale is quite large (~40 acres). Still, local incomes are lower (median worker income ~$30k), which caps what locals can pay for land unless outside money comes in.

Central Utah also has some unique markets like recreational subdivisions in the Manti-La Sal mountains (lot sales to out-of-county folks for cabins) and energy development in Juab/Millard (some land gets leased or sold for solar farms, wind projects, etc., which can increase value if your land is suitable for those).

On the whole, central Utah land is on a slow upward trend, but it’s more stable – don’t expect rapid spikes, but you can expect steady interest, especially for well-watered farms or view properties.

Southern Utah (Washington, Iron, Kane, Garfield)

Southern Utah includes the fast-growing St. George area (Washington County) as well as Cedar City (Iron County) and the gateway communities to national parks (Springdale by Zion NP, Moab in southeast Utah’s Grand County, etc.).

Washington County has been a star performer – it consistently ranks among Utah’s fastest-growing areas (projected ~1.5% annual growth long-term). Land near St. George that was once citrus orchards or raw desert is now in huge demand for housing, commercial centers, and retirement communities. As noted, residential lot prices in St. George can approach big-city levels (hundreds of thousands per acre).

Meanwhile, just outside the metro, you could find desert acreage at much lower cost. Southern Utah’s pattern is pockets of high value (e.g., around St. George, or around the touristy towns) and vast areas of low value. For example, Kane County (home to parts of Zion and lots of BLM land) has little private land, so any private parcel near Zion commands a premium (perhaps bought for a lodge or glamping site).

But head a bit east or west and you’re in empty sagebrush land. LandBoss indicates desert land in Southern Utah runs about $500–$5,000 per acre for the basic remote stuff. Scenic properties (views of cliffs, etc.) jump to tens of thousands per acre. Iron County (Cedar City) has a mix – Cedar City is growing (particularly with a new semiconductor plant being built nearby), so farm and industrial land around there is rising in value.

Yet further west in Iron County it’s very rural. Also, southern Utah has a factor of climate – its mild winter climate around St. George draws retirees (so demand for housing land), but also water is very scarce.

Sellers in places like Washington County might encounter land buyers who are very concerned with water availability – indeed, water rights in some southern Utah basins are closed (no new water can be tapped).

This can limit development potential unless the city extends utilities. Keep an eye on planned infrastructure projects like pipelines or highways (e.g., there’s long-standing talk of a Lake Powell pipeline to bring more water to St. George). Such projects, if they progress, could significantly affect land values by enabling more growth.

Eastern Utah (Uintah Basin, Carbon, Emery, San Juan)

Eastern Utah is energy country – Uintah and Duchesne counties have oil and gas fields, and Carbon/Emery are coal country with some farming in the river valleys. Land markets here tend to follow the boom-bust of the energy sector.

When oil prices are high and drilling is active, land near Vernal or Roosevelt might spike in value (for worker housing, equipment yards, etc.). When the industry slumps, land demand falls off. As of 2025, the oil market is moderate, so land values are fairly flat out there.

For instance, rangeland in Uintah Basin is often in the $1,000–$3,000 per acre range. If land has proven mineral potential (oil/gas), that’s another layer of value – sometimes companies will pay a premium or sign leases (so if selling, ensure you clarify whether mineral rights are included, as many older Utah properties have severed mineral ownership).

San Juan County in the far southeast is mostly tribal and federal land; the private land there is sparse and quite cheap (some of the lowest land prices in Utah, a few hundred dollars per acre for dry remote tracts). However, even San Juan has hotspots like around Bluff or Moab’s periphery due to tourism. Grand County (Moab) itself has had skyrocketing prices because it’s a recreation mecca – a tiny buildable lot in Moab city can be very expensive (and they have strict zoning to control growth).

In summary, local context matters enormously. A land seller should research their specific county’s market. Often, county assessors or local realtors can provide recent sale comps. Utah’s diverse regions mean you should compare apples to apples (e.g., compare your ranch in Monticello to other ranch sales in that area, not to a suburban lot sale in Lehi).

Factors Influencing Land Value in Utah

Why is one piece of land worth 10 times more than another? Several key factors determine land value, and understanding these can help you, as a seller, position your land advantageously:

Zoning and Land Use Regulations

Zoning is arguably the number one value driver for land. Zoning dictates what can be built on the property – for example, agricultural (A) zoning might only allow a farmhouse or barn, while residential (R) zoning allows homes (and the number of homes may depend on zoning density, like R-1-10 means one home per 10,000 sq ft lot, etc.), and commercial or industrial zoning allows businesses. Land that has flexible or higher-use zoning is significantly more valuable.

For instance, if you own 5 acres on the edge of town zoned agricultural, it might be worth, say, $100k as-is. But if you successfully get it rezoned to residential allowing, say, 1/4-acre lots, suddenly those 5 acres might yield 15–20 home lots, and the value could jump into the millions collectively. Verifying and potentially changing zoning is an important step.

Always check with the county/city planning department on your land’s zoning and what uses are allowed. If your land’s zoning is restrictive, you can either market it as a candidate for rezoning (if the general plan suggests future development there), or you might even go through a rezoning or subdivision process yourself before sale to unlock value (though that takes time and money).

Also be aware of zoning ordinances that might impose setbacks, height limits, etc., which could either enhance appeal (e.g., protected view corridors) or limit potential (e.g., can’t build more than one home).

Location and Accessibility

This old real estate adage “location, location, location” cannot be overstated for land. In Utah, location factors include proximity to population centers, transportation corridors, and natural amenities. Land along the Wasatch Front is valuable because it’s near jobs, schools, shopping – basically, where people want to live and companies want to operate.

Land near major highways (I-15, I-80, I-70, etc.) is generally worth more than land that’s 50 miles down a dirt road. For rural land, being close to a paved road or a town can boost value (nobody wants to haul building materials 30 miles on a rugged trail unless they really seek seclusion).

Access is critical: a landlocked parcel (no legal road access) is very hard to sell – in such cases, securing an easement or right-of-way across neighboring land can greatly improve sale prospects. If your land has direct highway frontage or interstate visibility, that might attract commercial developers (for gas stations, billboards, etc.).

Also, the atmosphere or character of the area matters – for example, Park City’s upscale resort atmosphere means even raw land there is perceived as luxury. By contrast, an identical piece of land in a depressed area won’t fetch much.

Topography and Terrain

Utah’s terrain ranges from flat valley floors to steep mountainsides. The buildability of land is a huge factor. Steep slopes, rocky outcrops, floodplains, or wetlands can reduce usable acreage and add costs to development. If a parcel is mostly flat or gently sloping, with good soil, it’s much easier to build on (hence more valuable) than a parcel that is half cliffs.

As a seller, it’s wise to know your land’s geotechnical characteristics – if you have a survey or soil report, that can reassure buyers. For instance, some areas in Utah have collapsible or expansive soils that require special construction measures.

If your land is in a known flood zone or has a portion that’s marshy, expect that portion to be valued lower (maybe as open space only).

On the flip side, interesting terrain can sometimes be a selling point for recreation – a property with a mix of forest, meadow, and a small canyon might attract someone looking for a private retreat more than a featureless flat lot would.

Highlight positives like views, natural features (streams, ponds, unique rock formations), but also be transparent about any challenges like a portion being very steep. Typically, only a fraction of mountainous land is actually developable (roads/driveways might be difficult), so effective acreage for building is considered by buyers.

Utilities and Infrastructure

Whether a piece of land has access to utilities (water, sewer, electricity, gas, internet) can drastically change its marketability. Land with utilities in place (or at least at the property line) is often termed “improved land”, whereas totally raw land without hookups is “unimproved”.

Improved land can be 20–30% more valuable than comparable unimproved land, because the buyer saves the hassle and cost of bringing services in.

Is your land hooked to city water, sewer, or electricity?

In city areas, you’ll want to check if your land is hooked to city water and sewer, or if not, whether those lines are nearby.

In rural areas, the question is usually if there’s a well (or water company connection) and electricity. Solar power can substitute for electricity in remote off-grid land, but not having water is a bigger problem (drilling a well in Utah can be expensive and not always successful, depending on groundwater availability).

If your land is within a culinary water district or includes irrigation water rights, definitely advertise that.

Sewer vs Septic

If land is not near a sewer line, building will require septic systems – for larger developments, that’s a limiting factor because you can only put so many homes on septic in a given area due to soil percolation requirements.

So, smaller towns often won’t allow dense development without extending sewer infrastructure.

As a seller, you might not solve these issues yourself, but know that a sophisticated buyer will assess them. Sometimes, landowners will do improvements like drilling a well, running a power line, or grading a road to boost the land’s appeal and justify a higher price.

This can be worth it if market demand is strong for “ready to build” land. In Utah’s context, also think about irrigation and canals on farmland – land with irrigation (water rights) is far superior to dry farmland.

Internet or Cell Coverage

Lastly, internet and cell coverage can be a factor nowadays – if your land has fiber optic or good 5G service, mention it; many rural buyers working remotely care about connectivity.

Economic and Demographic Trends

Broader trends such as population growth, job growth, and interest rates influence land demand. We’ve discussed Utah’s population boom – young families and in-migration feed demand for housing land.

Job growth in tech (the “Silicon Slopes” in Lehi), in logistics (new warehouses), and other industries means more commercial land demand as well.

If a big employer announces a move to your area, land values can shoot up (for example, Meta (Facebook) building a data center in Eagle Mountain drove up local land prices; a proposed oil refinery or manufacturing plant can do similar in rural areas).

Keep an ear out for news – sometimes holding land until a city announces a new freeway or a university extension campus, etc., can mean selling at a higher price. Conversely, if a one-company town loses that company, land prices can dip.

Interest rates are another economic factor: high rates can price out some buyers, reducing competition for land and softening prices, while low rates do the opposite. Land is often a cash-heavy purchase (loans for land are harder to get than home mortgages), so interest rates might affect developers more than individual rural buyers.

Tax and Legal Considerations

Taxes can affect land value indirectly. Utah has relatively low property taxes (and the Greenbelt program for farmland as mentioned, which keeps holding costs low for ag land). This means owners aren’t forced to sell by high taxes as happens in some states, so supply stays lower. However, a buyer will consider future property taxes if they develop (a shopping center will pay more tax than a hay field).

Utah also has no state property transfer tax and a moderate capital gains tax (5% state plus federal). One legal tool, the 1031 exchange (Internal Revenue Code §1031), can benefit sellers: it allows you to sell your land and reinvest the proceeds into other real estate, deferring capital gains tax.

Many savvy land owners use this to trade up – for example, selling a farm that got very valuable and buying a larger farm elsewhere or investment property, without immediate tax hit. This isn’t a direct factor in value, but it can broaden the pool of buyers (investors may be specifically looking to 1031 exchange into a land purchase).

Also, be aware of any restrictions or encumbrances on your land: conservation easements, mineral leases, rights-of-way, zoning overlays (like being in an earthquake fault zone or military overflight zone) – these can all impact value. Disclosure of these is important to avoid surprises during due diligence.

Environmental and Recreational Factors

Utah’s outdoorsy culture means things like proximity to trails, public lands (National Forests, BLM land), parks etc., can add value especially for recreational and residential land. A parcel that borders a National Forest effectively enjoys a huge “backyard” of protected land – hunters, hikers, and solitude-seekers love that (it could raise value for that niche).

If your land has a historical or cultural site (like ancient petroglyphs or pioneer buildings), that might attract certain buyers or conversely impose restrictions if it’s protected.

Also consider wildfire risk (forested lands might require mitigation) and climate (high elevation lands have short building seasons, which might deter some).

In southern Utah, scenic view protections (like dark sky ordinances or height limits near parks) exist in some areas – beneficial for preserving beauty, though potentially limiting building heights.

By evaluating all these factors, a land seller can better justify their asking price and target the right selling points in marketing.

For example, if your land is currently zoned agricultural but sits next to a city boundary, your pitch might be “excellent future development potential.” Or if it’s remote recreation land, you might highlight “borders thousands of acres of BLM land for limitless outdoor recreation.”

Use data when possible – for instance, cite that the county’s population grew X% or that “8 of the 10 fastest-growing cities in Utah are in my county” to emphasize demand. Being knowledgeable about these factors also helps in negotiations, as buyers will bring them up.

Strategies and Tips for Selling Land in 2026

Selling land can be quite different from selling a house. Land buyers often evaluate properties in more varied ways and may have longer timelines. Here are some actionable tips for Utah land sellers:

- Do your homework (comps and appraisals)

- Enhance curb appeal

- Highlight key selling points

- Choose the right sales method

- Be patient, but proactive.

- Understand the deal structure and taxes

- Leverage Utah-specific programs

We have a comprehensive guide on how to sell your land in Utah here.

2026 Market Outlook and Predictions

Looking forward, what can Utah land sellers expect in 2026? The consensus among real estate analysts is cautiously optimistic.

Utah’s fundamentals remain strong

A growing population, diversified economy, and enduring appeal for both businesses and outdoor-loving residents. Here are a few key predictions and trends likely to shape the land market in 2026:

Continued Price Growth, But Modest

Land values in Utah are expected to increase further in 2026, but at a more modest pace (perhaps on the order of a few percent up to mid-single-digit percentage growth). The era of 15–20% annual jumps is likely past, barring a return of ultra-low interest rates or another wave of in-migration.

The slowdown in 2023–24 (where, for example, home prices were basically flat and farmland value growth decelerated from earlier peaks) set a more sustainable trajectory. Sellers can expect that well-located land will appreciate, especially given Utah’s limited supply, but they should also be realistic – buyers will not blindly pay any price, especially with higher financing costs.

Interest Rates and Economic Climate

Many experts anticipate that the Federal Reserve may start cutting interest rates slightly in late 2025 or 2026 if inflation cools. If that happens, borrowing becomes easier and we could see a bump in land-buying activity (developers locking in land before rates fall further, etc.).

If rates remain high, the land market will likely stay in its current balanced state – serious buyers only, and more creative financing. Land sellers might see more offers where the buyer asks for seller financing (e.g., the buyer pays 20% down and the seller carries a loan for the rest for a few years). This can actually be a win-win if the seller is willing – it widens the buyer pool and the seller can earn interest.

On the economic side, Utah’s job market is strong, but any national recession would have some cooling effect on real estate. The “fog of uncertainty” including questions about interest rates, construction costs, etc., means 2026 isn’t without risks. But Utah has outperformed many states in resilience.

High-Growth Areas Leading the Way

Expect the fastest-growing counties, Wasatch, Utah, Washington, Tooele, Morgan, to continue to be hotbeds of land activity. These areas might actually see above-average land price increases because they are relatively less built-out. Wasatch County (Heber) is seeing major developments proposed (e.g., Mayflower Mountain Resort near Deer Valley, expansion in the Jordanelle area) which will drive up land demand.

Tooele County (west of Salt Lake) is another to watch: with continued growth along the Wasatch Front, more people are moving into the Tooele Valley for affordable housing, so raw land there could spike. Morgan County might see newfound interest if a proposed railway or distribution centers come, given its location along I-84 and I-15 junction.

For sellers in these counties, 2026 could be a great time to sell into a rising market. Meanwhile, rural areas with stagnant populations (like some eastern Utah counties) may remain flat in value, unless energy prices surge or tourism creates niche demand.

Housing and Affordability Pressures

Utah’s leaders have been grappling with housing affordability. There’s discussion of zoning reforms to allow more housing units (like duplexes, ADUs) in traditionally single-family zone. If some of these reforms pass in 2026, they could unexpectedly free up new opportunities for land development in urban areas (e.g., larger lots being split, or commercial parcels being allowed to add residential units). For landowners, this could raise land values by increasing what can be done on a given parcel (density bonus).

Keep an eye on legislative changes or city code updates. Additionally, the push for “attainable housing” might bring incentives: for instance, some cities might offer faster approvals or fee waivers for projects that include affordable housing. A landowner might partner with developers to leverage that.

On the flip side, if affordability doesn’t improve, demand might shift further to less expensive markets – some Utahns might choose to buy land in Idaho or elsewhere, potentially softening demand at the very high end in Utah. But given Utah’s growth, it’s more likely we’ll see continued pressure to build more, not less.

Emerging Uses

Data Centers

New trends can create new land markets. Utah has been attracting data centers (thanks to cheap land and decent fiber and power infrastructure) – for example, the Eagle Mountain area where Facebook/Meta is building. Data centers need large parcels (often 50+ acres) with good utilities.

Solar Farms

Solar energy farms are also proliferating in Utah’s sunny deserts. Companies leasing or buying land for utility-scale solar (or wind in some windy spots) give rural landowners another potential buyer aside from agriculture. If you have land in a high solar irradiance area near transmission lines (much of western Utah fits this), 2026 might bring opportunities to sell or lease to energy companies.

Logistics and Warehousing

Similarly, logistics and warehousing is growing – the region west of Salt Lake Airport, or down by Cedar City (along I-15), has seen big warehouses go up, requiring significant acreage.

Mergers and acquisitions in industries like real estate investing trusts (REITs) could lead to major land purchases (for instance, a REIT buying multiple industrial parcels to develop). These niche but important trends mean that land with certain attributes (flat, near power and roads for solar; or near highways and rail for warehouses) might see an uptick in demand beyond the usual local suspects.

Environmental and Quality of Life Factors

Utah’s natural beauty will continue to drive land demand for recreation and second homes. If anything, the remote work trend, though somewhat pulled back, has left a lasting impact – more people realized they could live anywhere, and many chose places like rural Utah. So recreational land (cabins, etc.) should maintain a solid market in 2026.

Tourism

Tourism numbers are expected to remain high (national parks see millions of visitors), which means towns like Moab, Kanab, and Torrey might need more lodging or vacation rentals – hence land for those uses.

Water Supply

On the environmental front, water remains the wildcard. Prolonged drought could lead to tighter water usage regulations. Utah has already been investing in water-saving and pondering pipelines.

If water shortages worsen, areas without secure water could see land demand dry up. Conversely, any breakthrough in water infrastructure (like a pipeline groundbreaking) could boost confidence in long-term development in places like St. George.

Wildlife Risk

Wildfire risk is another issue – a bad fire season can temporarily spook land buyers in mountain areas (due to insurance issues), but also increases interest in clearing and mitigating land. Land that has been responsibly managed (firewise cleared, etc.) might be more appealing.

In summary, 2026 looks to be a year of steady opportunity for land sellers in Utah.

By all indicators, Utah will keep growing – meaning land, the fundamental resource for that growth, remains valuable. Sellers who stay informed of market conditions and remain flexible (for example, considering creative deal structures or new types of buyers) should find success.

It’s a good practice to regularly check reports like the Gardner Institute’s housing and demographic reports, USDA land value reports, and even national trend reports (like PwC/ULI’s Emerging Trends) to gauge the mood. For now, the mood in Utah real estate is “cautious optimism” – caution due to uncertainties, optimism because the long-term demand outlook is bright. Navigate that balance, and you can make savvy decisions about if and when to sell your land.

Conclusion

Utah’s land market heading into 2026 remains strong, diverse, and full of opportunity. Although the frenzy of the early 2020s has eased, demand still outpaces supply in many regions, keeping conditions favorable for sellers.

From farmland to urban lots and scenic recreational acreage, each parcel carries unique value shaped by location, zoning, and regional growth.

To succeed, understand your land’s strengths and price it using solid data. Leverage market reports, county records, and professional guidance to present your property clearly and confidently. Utah’s limited private land and high desirability mean there’s almost always a buyer—developers, farmers, investors, or families looking for space with a view.

With forecasts pointing to steady or gently rising prices in 2026, sellers can plan strategically rather than rush. Selling land is both a financial and personal decision, and combining compelling positioning with accurate information will help you achieve the strongest possible outcome.

Here’s to your success in navigating the Utah land market of 2026 – may you find the right buyer and the right price, and move forward confidently to your next venture or investment. Happy selling!